Oil And Gold Forecast, News and Analysis:

- Home

- Latest Energy News

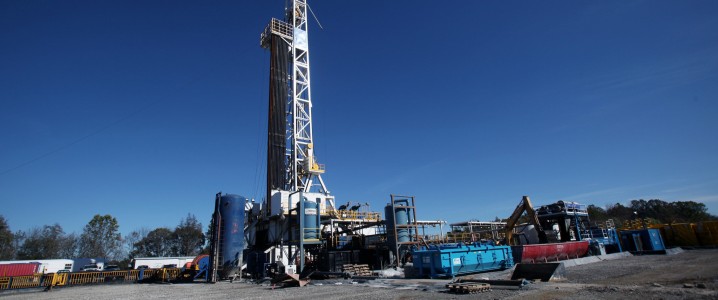

Aethon Eyes $10 Billion Move as Data Demand Grows

Aethon Energy Management is exploring strategic options for its $10 billion natural gas assets, potentially setting the stage for one of the largest transactions in the U.S. natural gas sector in recent years. Working with investment giants Goldman Sachs and Citigroup, Aethon is considering both a sale and an initial public offering, with a final decision expected by 2025.

As one of the nation’s largest private natural gas producers, Aethon’s assets include significant upstream and midstream holdings, primarily concentrated in the prolific Haynesville region.

‘;document.write(write_html);}

The timing of Aethon’s decision to rid itself of its natural gas assets comes as demand for natural gas surges as data centers and artificial intelligence clamor for more and more power. It also comes at a time when the U.S. generates 43.1% of its electricity from natural gas, according to the Energy Information Administration—and that percentage is growing.

‘;document.write(write_html);}else{var write_html=’

ADVERTISEMENT

‘;document.write(write_html);}

In fact, over the past few years, dozens of pundits and industry experts have emphasized that the ongoing Fourth Industrial Revolution is driving unprecedented electricity demand growth in the United States and globally, with an anticipated 15% surge in US electricity demand over the next decade, driven primarily by AI, clean energy, and cryptocurrency.

Data centers have become perhaps the biggest drivers of additional electricity demand in the United States, as Big Tech companies race to get ahead in the development of artificial intelligence systems. This requires a reliable 24/7 power source that renewable energy alone cannot meet, underscoring the role of natural gas in the energy mix.

Aethon has expanded its footprint in the U.S. energy sector and boasts more than 1,400 miles of pipelines and production facilities along the Gulf Coast. Its proximity to LNG export facilities only adds to the appeal as demand for U.S. LNG rises in international markets.

Recent high-profile transactions, such as EQT’s acquisition of Equitrans Midstream and the Chesapeake-Southwestern merger paint a picture of a growing consolidation trend in the industry.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com

- India Aims To Become Regional Refining Hub

- Venezuela’s Gas Pipeline Explosion Highlights Crumbling Infrastructure

- Dutch Court Ruling May Redefine Energy Sector

Join the discussion | Back to homepage

Source: https://oilprice.com/

More Stories

Russia Not Releasing Details of Talks with the U.S. on Ukraine

Glencore Cuts Coal as Market Glut Smothers Prices

Oil Rises on Larger Than Expected Crude Draw