Oil And Gold Forecast, News and Analysis:

- Home

- Latest Energy News

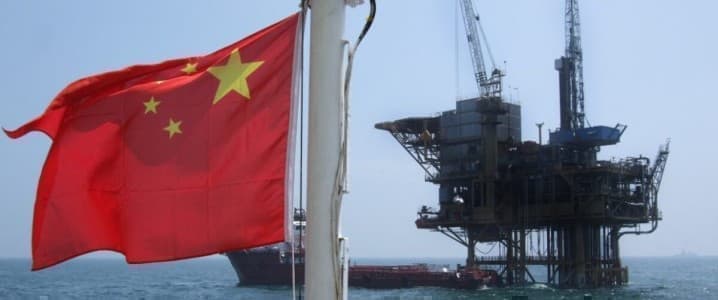

CNOOC Launches Joint Development Project in South China Sea

CNOOC Limited has brought three Panyu oilfields online in the South China Sea, marking a significant step in its strategic development. The project integrates the Panyu 11-12, 10-1, and 10-2 oilfields, leveraging state-of-the-art facilities, including a “Typhoon Production Mode” and heavy oil intelligent processing system. The development is expected to peak at 13,600 barrels of oil equivalent per day (boepd) of medium and heavy crude oil in 2025, and improves efficiency and sharing costs by connecting new platforms with existing ones via a trestle bridge.

The project is located at an average water depth of 100m and includes an unmanned wellhead platform.

‘;

document.write(write_html);

}

Since 2003, the Panyu cluster has produced over 380 million barrels of crude, making it a cornerstone of CNOOC’s operations.

CNOOC said that 15 development wells are planned for commissioning,

CNOOC holds 100% interest in the project and is the operator, after acquiring Devon Energy Corporation’s interest in Panyu for $515 million back in 2010.

The Panyu oilfield has produced more than 380 million barrels of oil since it was brought online in 2003.

Meanwhile, CNOOC booked a record profit of $5.2 billion for the third quarter of 2024—up 9% over the same period in 2023. In the fourth quarter, CNOOC reached a deal with Ineos to sell off its US oil and gas businesses valued at $2 billion, and includes takes in two deepwater fields in the Gulf of Mexico.

The success follows another from CNOOC at the Jinzhou 23-2 oilfield in the Bohai Sea last month, which is expected to reach peak production of 17,000 boepd by 2027, and another success with the Huizhou 26-6 oilfield development project, which should add 20,600 boepd by 2027. Those projects are also fully owned by CNOOC.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com

- A Look at the Geopolitical Landscape Heading into 2025

- Oil Demand Stays Strong Despite EV Surge

- Exxon and Chevron Expand Global Hiring Push

Join the discussion | Back to homepage

`;

document.write(write_html);

}

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

More Info

Leave a comment

Leave a comment

Source: https://oilprice.com/

More Stories

Dallas Fed Survey Respondents Bearish on Short Term Oil Prices

Russia Not Releasing Details of Talks with the U.S. on Ukraine

Glencore Cuts Coal as Market Glut Smothers Prices